Modern dentistry is a symphony of precision and performance, choreographed by technology that seamlessly blends the science of healthcare with the sophistication of IT.

However, the reality many dental practices often face is the high cost associated with this cutting-edge technology. Amidst this financial hurdle, there shines a ray of cost-saving hope — the often overlooked, yet powerful, Section 179 of the Tax Code. This provision can significantly ease the financial burden of integrating tech innovations into your practice.

For dentists and dental office managers, understanding Section 179 isn't just about taxes; it's about optimizing your practice and enhancing the patient experience, a win-win in the healthcare industry. This helpful guide outlines Section 179 and how it applies to dental practices.

Understanding Tax Code Section 179

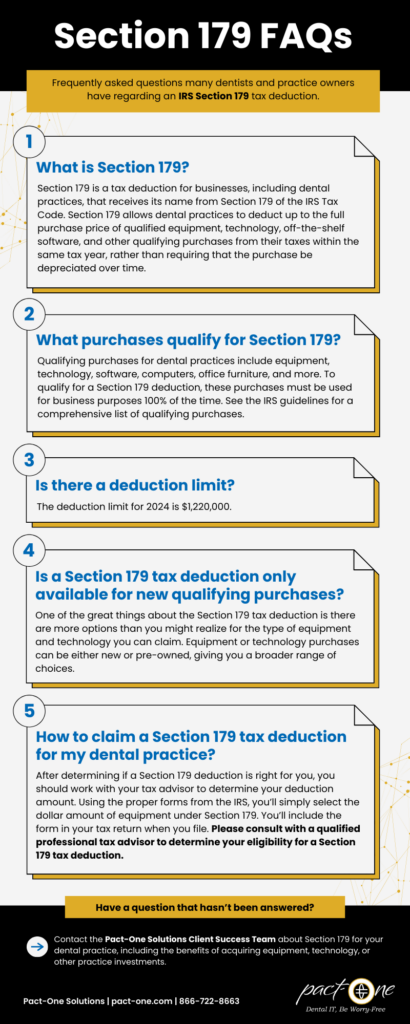

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed from taxable income. It's a monetary lifeline for small businesses looking to reinvest in their growth.

For dental practices, this can translate to substantial savings when acquiring necessary technology and equipment for your dental office.

Section 179 Deduction Amount for 2024

For the tax year 2024, Section 179 deduction limit stands at $1,220,000 (which is an increase of $60,000 from 2023’s limit), meaning you can buy up to this amount in qualifying equipment and write off the whole sum on your taxes. But don't get too carried away — there's a total equipment purchase limit of $3,050,000, after which the deduction amount begins to phase out on a dollar-for-dollar basis.

So, if you're planning a tech overhaul, be sure to calculate your purchases carefully to maximize your deductions. From the tiniest dental probe to a sophisticated database server, every tool counts.

Dental Equipment and Technology Eligible Under Section 179

The extensive list of items that qualify for Section 179 deduction includes many types of equipment crucial to dental operations:

- X-Ray machines and digital imaging equipment

- 3D scanners and printers for creating dental prosthetics

- Management software

- Computers and IT infrastructure

- Office furniture and equipment

Understanding the breadth of qualifying equipment is key to maximizing deductions under Section 179.

Upgrading Technology in Your Dental Practice

The decision to upgrade technology in your dental practice is multi-faceted. You must evaluate not only the benefits to patient care but also the financial and operational impacts on your practice. When does it make sense to upgrade, and what factors should you consider?

Evaluating the Need

Outdated technology can lead to inefficiencies and errors that affect the bottom line and patient outcomes. An honest assessment of your current tech's performance is the first step. Talk with your dental IT company or reach out to a qualified dental IT consultant to help aid you with this endeavor. They should be able to provide you with a breakdown of your technology, such as:

- All equipment on your network

- Warranty status of equipment

- Requirements of software and if current equipment aligns

- End-of-Life technology

- Overall age, health, and storage capacity of computers

Financial Implications

The cost of new technology is often the greatest deterrent. Utilizing Section 179 can make these investments more palatable by providing tax savings to offset initial expenses. Additionally, you can even finance or lease your equipment and still claim the Section 179 Deduction. This provides you with the opportunity to deduct the full amount of your purchase without paying the full amount in the current year.

Return on Investment

Consider the long-term benefits and potential ROI of technology upgrades. How will the new equipment improve patient satisfaction, and will it help you attract and retain clients?

- 3D imaging (via intraoral scanners) can provide a more comfortable experience for patients when compared to the alternative of an impression tray

- 3D printing helps create crows, dentures, bridges, etc. in-office rather than wasting time and money sending the impressions to a dental lab

How to Leverage Section 179 in Your Dental Office

Understanding Section 179 is one thing; leveraging it effectively is quite another. Here are steps to ensure you're maximizing the benefits for your practice.

Strategic Planning

Begin your planning long before tax season. Evaluate needs, research equipment, and consult with financial advisors to create a strategic technology acquisition plan. It’s beneficial to consult with a qualified dental IT company that can match you with technology solutions that fit your practice and budget (access to better hardware, time-saving tech, and budget-friendly IT solutions).

Deadline for Section 179 Deduction

The deadline for Section 179 Deduction is at the end of the current year (for example, December 31, 2024). You have until the end of the year to upgrade your equipment and software and claim the deduction for the 2024 tax year.

Maximizing the Deduction

To claim the full Section 179 deduction, ensure that your qualifying equipment is in service before the end of the tax year. Timing your purchases strategically can help maximize the deduction amount. To qualify for the deduction in the current tax year, the equipment must be financed or bought and put into service between January 1, 2024, and December 31, 2024.

A dedicated dental IT company, such as Pact-One Solutions, can help you build a plan and project that aligns with your dental office’s technology needs and timeline.

Calculate Your Estimated Savings with Section 179 Tax Deduction

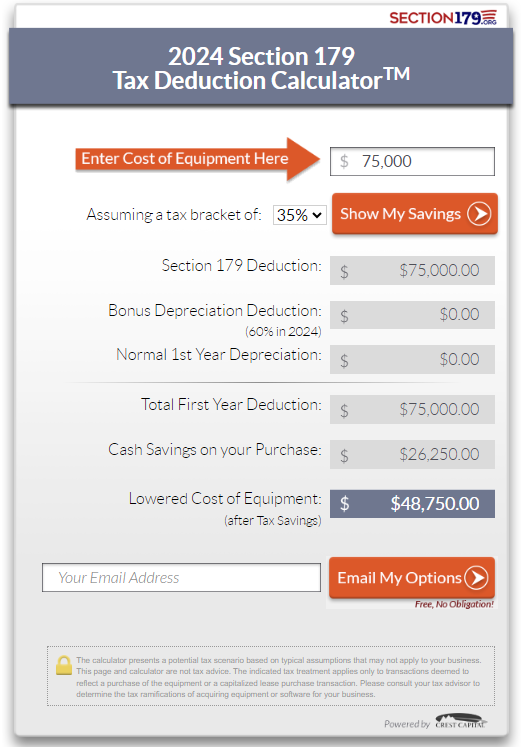

To help visualize your potential savings, the Section 179 Tax Deduction Calculator is an invaluable tool. All you need to do is enter the cost of your prospective equipment or software into the calculator. It will then provide an estimate of your tax savings and your net cost after the Section 179 tax deduction.

It's a straightforward way to see how this tax deduction can lower the actual cost of your equipment purchase, making that upgrade more possible.

Section179.org example of equipment costing $75,000 generates a savings of $26,250 by using the Section 179 Deduction to drop the actual cost of equipment to $48,750 (whether bought, financed, or leased).

Conclusion

The intersection between technology and tax law holds the potential to transform dental practices from the archaic to the state-of-the-art. For those who have yet to take advantage of Section 179, there lies an untapped opportunity to not only upgrade equipment but also to refresh the practice ethos. Investing in technology isn't just about maintaining a competitive edge; it's a statement of commitment to both patient wellbeing and the financial health of the practice.

It's time to ensure your dental office is not only equipped to meet current standards but also assured to exceed them, and Section 179 can be the facilitator of that transformation. The key to unlocking this potential begins with exploration, planning, and action.

Disclaimer

This article is designed to deliver general information and should not be taken as legal, financial, or tax advice. The intricacies of Section 179 and its applicability can differ significantly across various business scenarios. It’s crucial to see guidance from a qualified financial advisor or tax consultant tailored to your unique business needs before making decisions that could affect your dental practice’s tax liabilities or financial standing.

Despite diligent efforts to maintain the accuracy and up-to-date nature of this content, tax regulations, eligibility criteria, and the nuances of Section 179 are subject to change without prior notification. For the latest and most relevant information, consulting with a professional tax advisor is strongly recommended.

Dental IT. Remove the Burden. Embrace the Use.

Quality patient care – it's ultimately why you became a dental professional. But, some business operations can get in the way (such as pesky computer issues or lack of IT support). That’s where Pact-One Solutions can help! Our passion lies in supplying reliable, responsive dental IT support and security that practices can count on.

Whether you’re looking for dental IT services for your startup or searching for more responsive dental IT support – our team of dental IT specialists have you covered. With team members throughout the United States, we offer nationwide support to dental practices of all sizes. Our wide range of dental IT services ensure your data is secure, accessible, and protected.

Don't let technology challenges hinder your ability to deliver exceptional dental care. Contact us at info@pact-one.com or 866-722-8663 to join 350+ dental practices thriving with the support of a dedicated dental IT team.

You must be logged in to post a comment.