The IRS has served up a toothsome treat for dental practitioners - the tax code Section 179, a golden ticket to a hefty new equipment deduction of $1,160,000.

So, whether you're contemplating upgrading that rusty old Windows 7 system, or you're needing to replace your Server 2012 (set to go End-Of-Life October 2023), there's never been a better time than now. And with the right dental IT support and network security, it's not just a smarter financial move, but one that could revolutionize your practice. So, stick around, and let's drill down into how you can turn your tech upgrade into a tax advantage.

Tax Code Section 179 - Deduction Details

In a nutshell, tax code Section 179 allows businesses—including dental practices—to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year.

That's right, if you buy (or lease) a piece of qualifying equipment, you can deduct the full purchase price from your gross income. It’s a stimulus designed to encourage businesses to buy equipment and invest in themselves. So, let's bite into the juicy details of these deductible delights and find out how to approach and make the best use of this generous window of opportunity.

Deduction Amount of Section 179

For the tax year 2023, Section 179 deduction limit stands at a whopping $1,160,000, meaning you can purchase up to this amount in qualifying equipment and write off the whole sum on your taxes. But don't get too carried away — there's a total equipment purchase limit of $2,890,000, after which the deduction amount begins to phase out on a dollar-for-dollar basis.

So, if you're planning a tech overhaul, be sure to calculate your purchases carefully to maximize your deductions. From the tiniest dental probe to a sophisticated database server, every tool counts.

Calculate Your Estimated Savings with Section 179 Tax Deduction

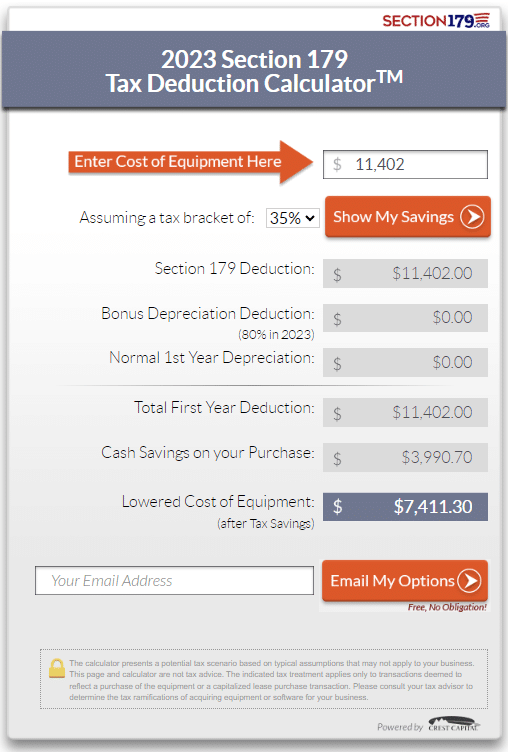

To help visualize your potential savings, the Section 179 Tax Deduction Calculator is an invaluable tool. All you need to do is enter the cost of your prospective equipment or software into the calculator. It will then provide an estimate of your tax savings and your net cost after the Section 179 tax deduction. It's a straightforward way to see how this tax deduction can lower the actual cost of your equipment purchase, making that upgrade even more attractive.

An example of replacing approximately four (4) computers and a server with equipment costing $11,402. By leveraging the Section 179 Deduction, the actual cost of the equipment – whether purchased, financed, or leased – drops to $7,411.30. That’s a savings of $3,990.70.

Qualifying Purchases for Section 179 Deduction

So, what exactly counts as a 'qualifying purchase' under Section 179? Qualifying purchases for dental practices include equipment, technology, software, computers, office furniture, and more.

To qualify for a Section 179 deduction, these purchases must be used for business purposes 100% of the time. This includes new and used equipment and off-the-shelf software. So, if you’ve been holding off on upgrading your end-of-life or outdated software and hardware due to cost, this may be the opportunity you’ve been looking for.

Upgrading Software and Hardware

Times change, and so does technology. Just like you wouldn't want to perform a root canal with outdated equipment, you don't want to run your practice on an ancient Windows 7 system or a decrepit end-of-life Server 2012. Upgrading your hardware and software is not just vital for staying competitive, it's also a critical part of maintaining secure and efficient operations.

- Computers and Servers: The typical lifespan of a computer or server is about 3-5 years. Beyond this, they become less efficient and pose serious security risks. Outdated systems are more likely to have unpatched vulnerabilities that can be exploited by cybercriminals.

- Software: Staying current with software updates offers the chance to benefit from advanced features that can enhance patient experience and streamline your business operations. For instance, newer practice management software can improve scheduling, billing, and patient communications, while the latest imaging software can offer superior diagnostic capabilities.

Investing in newer technology not only ensures you're using the most streamlined and efficient tools but also minimizes your vulnerability to cyber threats. It's a win-win situation—improved performance and advanced network security.

Deadline for Section 179 Deduction

The clock's ticking and you don't want to miss this excellent opportunity. The deadline for Section 179 Deduction is December 31, 2023. Yes, you heard it right! You have until the end of the year to upgrade your equipment and software and claim the deduction for the 2023 tax year.

But don’t wait until the last minute. Remember, to qualify for the deduction in the current tax year, the equipment must be financed or purchased and put into service between January 1, 2023, and December 31, 2023.

New Business Technology Upgrade with Pact-One

Section 179 is more than just a tax code; it's a tangible opportunity to modernize your dental practice while enjoying significant tax savings. And who better to guide you through this process than Pact-One, your trusted partner in dental IT support and network security.

Leveraging our extensive industry connections and expertise, Pact-One can help you source the best equipment and software tailored to your specific needs, all the way from procurement to complete installation – ensuring a hassle-free process for you and your team.

So, step into the future of dentistry with confidence, knowing that with Pact-One, you're not just upgrading your technology— you're upgrading your practice. Contact us today for a complimentary consultation.

Additional Helpful Resources for Section 179 Tax Deduction

Section 179 FAQs

Section179.org

You must be logged in to post a comment.